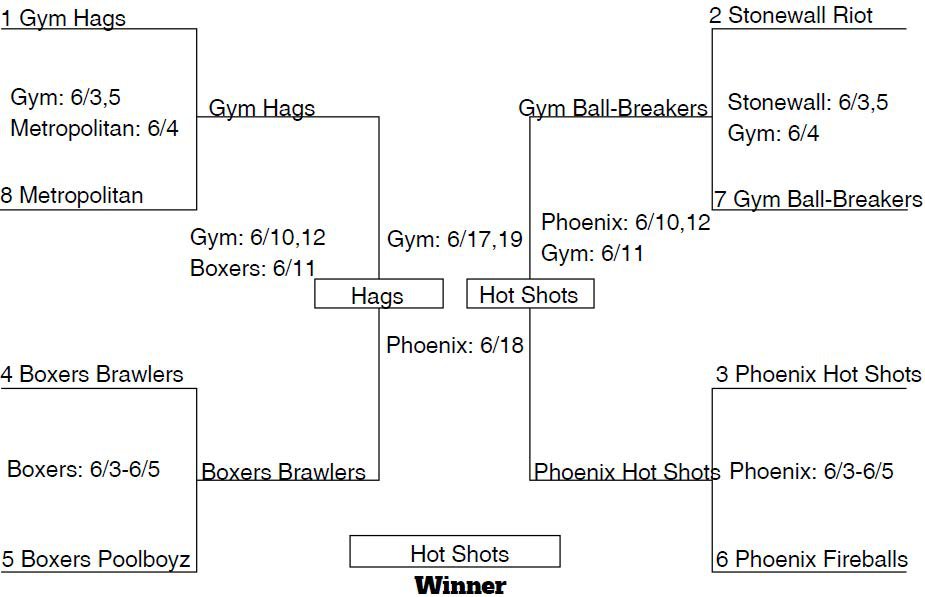

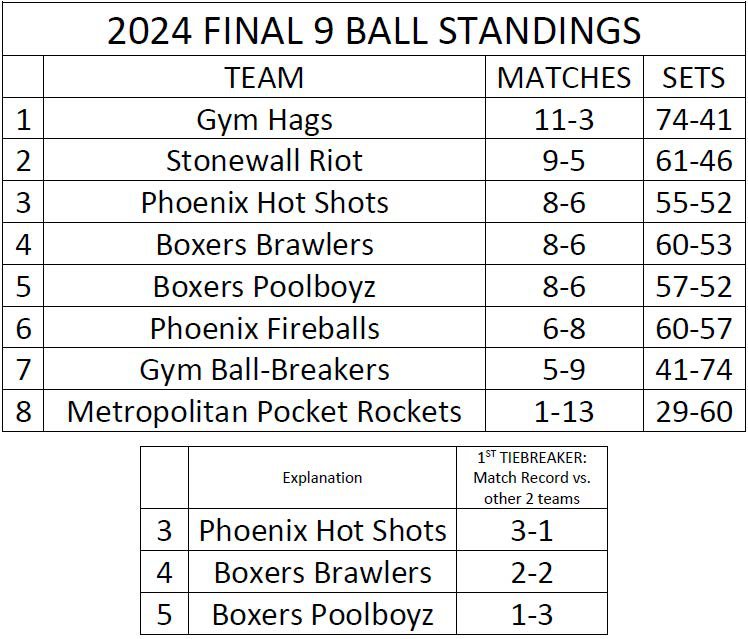

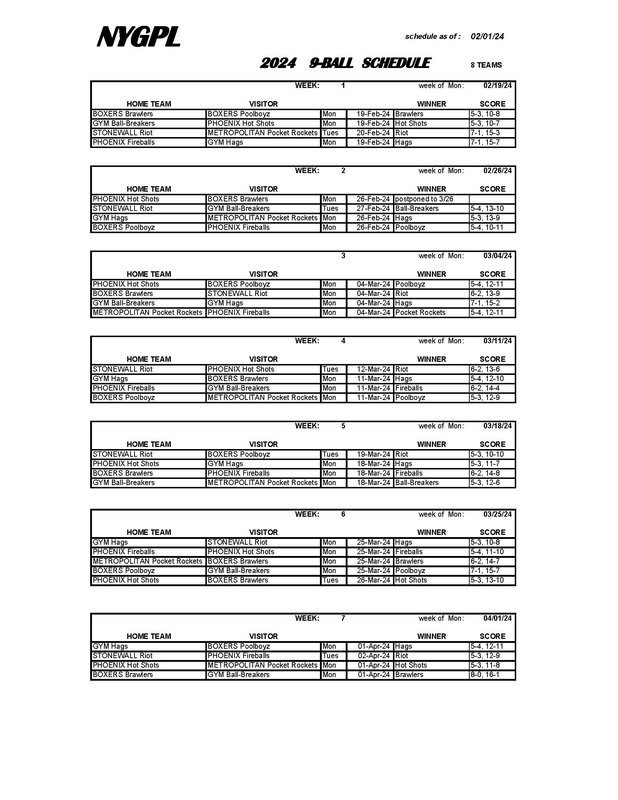

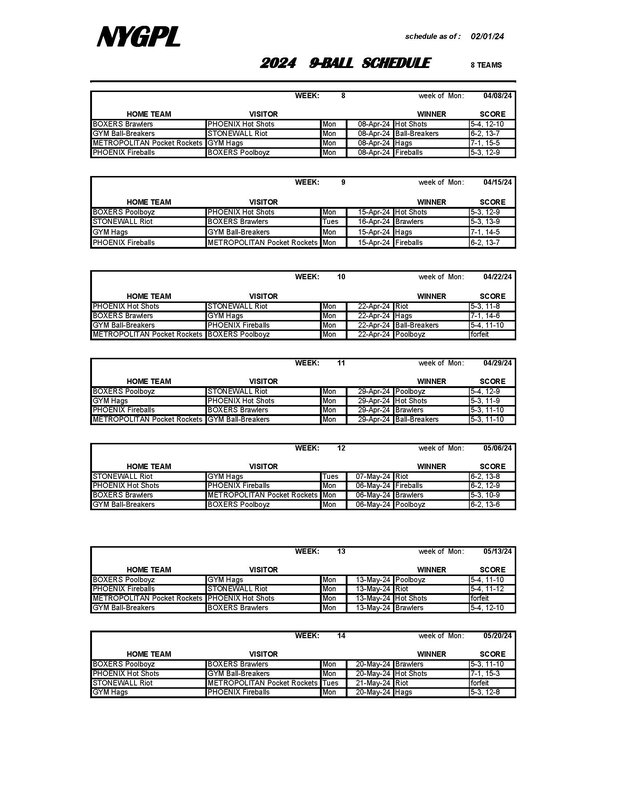

9 Ball Playoffs

_________________________

RULES OF PLAY

![]() NYGPL 8-Ball Rules of Play (342.6 KB)

NYGPL 8-Ball Rules of Play (342.6 KB)

![]() NYGPL 9-Ball Rules of Play (212.1 KB)

NYGPL 9-Ball Rules of Play (212.1 KB)

![]() NYGPL 8-Ball Scoresheet (130.7 KB)

NYGPL 8-Ball Scoresheet (130.7 KB)

![]() NYGPL 9-Ball Scoresheet (153.6 KB)

NYGPL 9-Ball Scoresheet (153.6 KB)

Not finding what you need?

Complete the form below and an Officer will contact you.

____________________

Past Seasons

ended June 13, 2022

ended Jan. 18, 2022

ended June 7, 2020

ended March 1, 2020

ended June 11, 2019

ended March 10, 2019

Member Bars

Click venue below to highlight on map and see upcoming events

Have a question, comment, or suggestion?

Fill out the form below and one of our officers will get back to you ASAP.

Founded in 1984, the New York Gay Pool League is a Not-for-Profit 501(c)(3) Corporation dedicated to raising money for HIV/AIDS charities. The Corporation is formed for the purposes of providing relief to poor, distressed and underprivileged, and indigent persons afflicted by the Human Immunodeficiency Virus (HIV) and/or the Acquired Immunodeficiency Syndrome (AIDS) virus in the New York City area. In furtherance of these charitable purposes, the Corporation shall disperse the funds raised to other organizations which are exempt from federal income tax under Section 501(c)(3) of the Internal Revenue Code of 1986, as it may be amended, and which provide relief, support, and services to the poor, distressed and underprivileged, and indigent HIV/AIDS afflicted community. The Corporation is not formed for and shall not be conducted nor operated for pecuniary or financial gain, and no part of its assets, income or profit shall be distributed to, or inure to, the benefit of any private individual or individuals.